INFRASTRUCTURE FIN-TECH APPLICATIONS FOR CASH FLOW PROJECTIONS, O&M BUDGETING, RATES, CAPITAL BUDGETING & FINANCING

INFRASTRUCTURE FIN-TECH APPLICATIONS FOR CASH FLOW PROJECTIONS, O&M BUDGETING, RATES, CAPITAL BUDGETING & FINANCING

Water utilities face mounting challenges related to water scarcity and unfunded mandates, creating a compelling need for a risk management system that can model revenue sufficiency and the impact that decisions will have on rates. Furthermore, waste water operations are pressed by aging infrastructure and the requirement for additional capacity, thus prioritizing the need for an on-demand, cost-of-service analysis. Changing weather patterns have also created a critical need for new storm water infrastructure involving capital expenditures, increased O&M expenses, and financing requirements. Make better decisions about rate increase timing and manage financial risk with the AQUA RATES PLANNER!

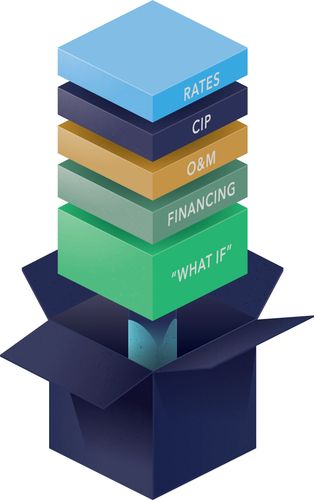

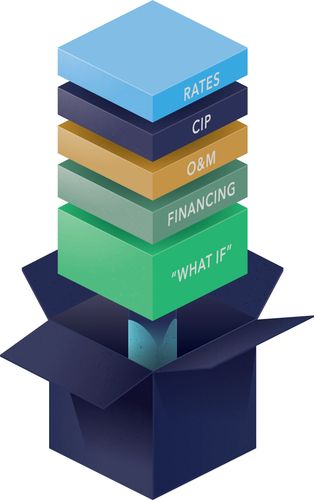

The need to plan, fund, and price capital infrastructure initiatives is a critical topic today. The options for funding these initiatives have increased along with the complexity and the need to assess financial feasibility from various revenue sources. A dynamic pricing model is also essential to establish defensible fees and charges across customer service classes. These requirements, combined with emerging public/private partnerships, create a compelling need for a powerful budgeting, financing, revenue sufficiency, and pricing application. Using the INFRASTRUCTURE CAPITAL PLANNER take control of capital infrastructure projects and O&M budgets with the ability to quickly forecast revenue requirements!

Traditional energy utilities are challenged with regulations from the EPA resulting in unfunded mandates and the need to explore energy alternatives. Natural gas is an important and emerging source of energy, with approximately half the carbon footprint as coal. Alternative energy sources such as wind and solar are becoming more prominent, tapping into the inexhaustible energy of the sun. In order to truly model the financial impact of required capital infrastructure and the critical need to finance these initiatives, an online risk management system that can price energy rates is essential. Mitigate the risk of customer class rate shock and anticipate the future with the ENERGY RATES PLANNER!

CAPITAL OBJECTS has developed a comprehensive financial planning tool that revolutionizes the manner utilities track their present financial condition and plan for the future. The program gives a utility the ability to determine how every dollar spent and every dollar planned to be spent will effect cost to their present and future custo

CAPITAL OBJECTS has developed a comprehensive financial planning tool that revolutionizes the manner utilities track their present financial condition and plan for the future. The program gives a utility the ability to determine how every dollar spent and every dollar planned to be spent will effect cost to their present and future customer base. After working managing water, sewer and solid waste utility operations for forty years its finally here.

Terry Pinto

Director

City of Rockland Maine Pollution Control Department

The Aqua Rates Planner application is excellent. And the support provided us was outstanding. We really appreciate all that Capital Objects has done for us. Using the application allowed Western Heights Water Company to complete our rate study and develop a new 4 tier rate structure in-house, which saved us over $30,000 in consulting f

The Aqua Rates Planner application is excellent. And the support provided us was outstanding. We really appreciate all that Capital Objects has done for us. Using the application allowed Western Heights Water Company to complete our rate study and develop a new 4 tier rate structure in-house, which saved us over $30,000 in consulting fees. The application provides us detailed insight about our revenues, expenses and how the water rates support our financial goals.

Mark E. Iverson, P.E.

General Manager

Western Heights Water Company